I am

Boost your business or personal goals effortlessly with our financing solutions. Access the equipment you need without any upfront hassles. It's your equipment, your way - pay conveniently with manageable monthly installments while maximizing its full potential.

Finance your purchases starting at 0% interest up to 60 months.

We take pride in offering diverse financing solutions for consumers and businesses. With fair interest rates and flexible terms, we've partnered with the top financing companies in the country to provide convenient, affordable , and accessible plans for everyone. Break down your purchases into manageable payments, making your business & personal endeavors within reach.

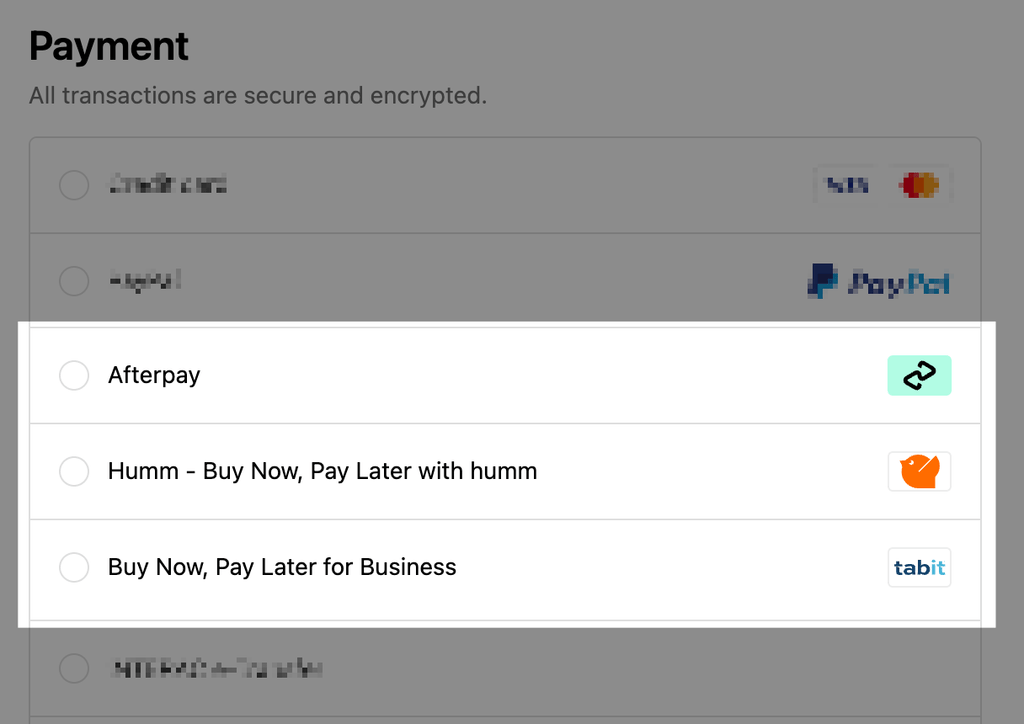

At checkout, you'll be able to select among one of several financing providers. Different providers offer different terms and interest rates, so choose the one that suit your needs best.

Use the form below to help you find the best financing options and payment terms for your needs.

I am

| Provider | Amount Range | Payment Terms | Interest Rate |

|---|---|---|---|

AfterPay AfterPay

|

Up to $2,000 | Bi-weekly (Up to 6 weeks) | 0% |

Humm Humm

|

Up to $1,500 | Bi-weekly (Up to 6 weeks) | 0% |

Humm Humm

|

$1,500 to $30,000 | Monthly (6 - 60 months) | 11.99% |

Tabit* Tabit*

|

Up to $500,000 | Weekly (1 year) | 0-9.99% |

Have questions about your any of our financing options? Visit our Trimleaf Financing help page, give us a call at 1-778-300-3154, or write to us!